VDB Loi Laos Alert – Presidential Edict on royalty rate for natural resources

January 15, 2016Recently, the President of the Lao PDR issued Presidential Edict No. 001/P dated 15 December 2015 (“the Edict”) regarding the royalty rate for natural resources.

The Edict imposes royalty rates for natural resources as follows:

- For general mineral resources – from 2% to 10% of the sales value, depending on the type of mineral.

- For mineral resources serving construction activities – from LAK3,000 LAK7,000 per cubic meter.

- For forest resources – from 4% to 50% of the sales value, depending on the type of resource.

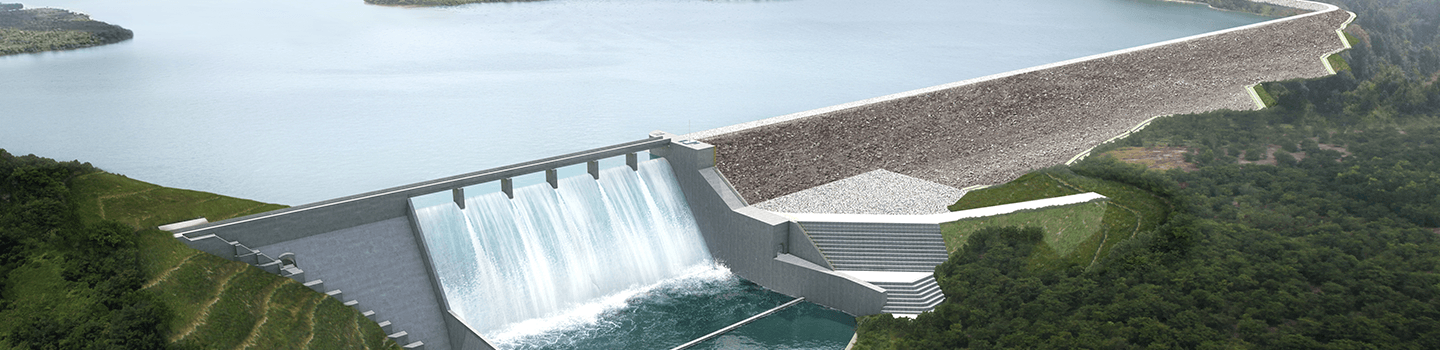

- For water resources serving hydropower electricity projects – 5% or more depending on the project capacity.

- For water resources serving manufacturing and service activities – from LAK5 to LAK10 per cubic meter, depending on the type of activity, e.g. industrial processing, mining activities, tourism, and water supply.

The Edict comes into full force and effect from 14 January 2016. All domestic and foreign individuals and legal entities operating a business in respect of the use of natural resources are to implement this Edict, except for projects that have been granted fixed rates in accordance with an executed concession agreement.

Should you have any questions regarding this, please do not hesitate to contact Ms. Daodeuane Duangdara ([email protected]) or Mr. Sornpheth Douangdy ([email protected]).

Did you know that VDB Loi Laos is licensed to provide compliance accounting services to complement our tax compliance services?

VDB Loi is a network of leading law and advisory member firms and affiliated companies that comprises eight partners and over 100 lawyers and advisors, with offices in Cambodia, Indonesia, Laos, Myanmar and Vietnam and representatives in Singapore and Tokyo. We provide the highest quality solutions for transactions and taxation.

You can find more information on our Laos office here.

KEYWORDS

RELATED EXPERIENCES

Related Articles

- Draft Amendment of the Constitution of the Lao PDR Posted for Public Consultation

- February 13, 2025 - The New 10% Value Added Tax Rate is Going to Be Effective Shortly! Are You Ready for It?

- April 26, 2024 - Presidential Edict No. 003/P Dated 19 March 2024 – VAT Rate to be Reset Back to 10% in 2024

- March 20, 2024 - The Lao Government Increases Excise Tax Rates

- October 23, 2023 - FY2021 Annual Submission and Dividend Income Tax

- May 24, 2022

This is single-publication.php