Circular No. 10 dated 20 August 2023 issued by the Department of Financial Institutions and Markets of the Bangladesh Bank on “Loan Rescheduling for the Shipbuilding Industry”

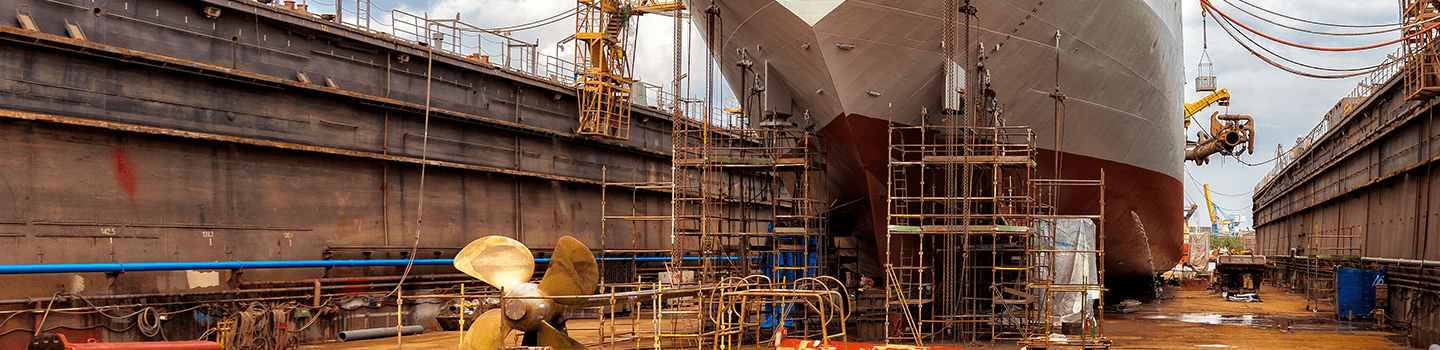

September 6, 2023In a concerted effort to recover bad debts and alleviate the burden of classified loans, the Bangladesh Bank has taken measures to ease the loan rescheduling process for the country’s shipbuilding industry. This initiative is aimed at facilitating smoother repayment processes.

Under the newly relaxed policy, non-bank financial institutions will now have the option to reschedule defaulted loans for borrowers in the shipbuilding industry for a duration of 10 years, which includes a two-year grace period. To access this rescheduling facility, financial institutions are required to collect a down payment equivalent to 2.50% of the defaulted loan amount. Loans obtained through fraudulent means or irregularities will not be eligible for this rescheduling opportunity.

Presently, Bangladesh boasts an impressive number of over 200 shipbuilding companies, with significant concentrations in key areas like Dhaka, Chattogram, Narayanganj, Barisal, and Khulna. According to a recent study conducted by the Bangladesh Investment Development Authority (BIDA), the shipbuilding industry contributes approximately Tk 15,000 crore to the country’s annual revenue.

KEYWORDS

RELATED EXPERIENCES

Related Articles

- Bangladesh Bank Eases Retention Rules for Export Proceeds in Specialized Zones

- September 8, 2025 - Bangladesh Bank Cuts SDF Rate to 8% to Boost Market Efficiency and Liquidity Management

- August 14, 2025 - The Bangladesh Bank Permits the Use of Offshore Banking Deposits as Collateral for BDT Financing

- August 14, 2025 - Bangladesh Bank Issues New Guidelines to Regulate Limited Money Changer Services

- August 14, 2025 - Guidelines for Offshore Banking Businesses – Expanded Scope of Services

- July 17, 2025